Executive Condo loans by HDB in Singapore offer affordable homeownership for first-time buyers and upgrades in areas like Punggol. To apply, citizens/residents aged 21+ must be first-time buyers meeting Gross Monthly Income (GMI) thresholds and participate in a fair balloting system. Lenders require detailed financial information and documents for compliance. Interest rates and flexible repayment options should be considered, with comparison recommended. Punggol's convenient location, modern amenities, and scenic beauty make Executive Condos an attractive choice. The application process involves lender research, document submission, verification, credit checks, and loan-to-value ratio assessment.

In today’s competitive real estate market, understanding executive condo loans is crucial for those seeking to purchase a prestigious home in vibrant Punggol. This comprehensive guide delves into the intricacies of these specialized mortgages, covering everything from eligibility criteria and lender requirements to interest rates and application processes. Discover the benefits of owning an executive condo at Punggol and navigate the steps with confidence.

- Understanding Executive Condo Loans: An Overview

- Eligibility Criteria for Punggol Executive Condos

- Lender Requirements and Documentations Needed

- Interest Rates and Repayment Options Explained

- Location-Specific Benefits of Punggol Executive Condos

- The Application Process: Step-by-Step Guide

Understanding Executive Condo Loans: An Overview

Executive Condo loans are a specialized financing option tailored for buyers looking to invest in or own an Executive Condo, such as those found at Punggol. These loans offer affordable and accessible home ownership opportunities with specific guidelines designed by Singapore’s government housing agency, HDB (Housing & Development Board). The program aims to provide a middle ground between public housing and private condominium purchases.

These loans are intended for first-time homeowners or those looking to upgrade their accommodation. They come with flexible terms and conditions, making them an attractive choice for many. Understanding the Executive Condo Loan Guidelines is crucial when considering such a purchase, as it ensures buyers can access these benefits and make informed decisions in the property market, especially in areas like Punggol where Executive Condos are increasingly popular.

Eligibility Criteria for Punggol Executive Condos

To be eligible for an Executive Condo at Punggol, applicants must meet specific criteria set by the Housing & Development Board (HDB). Firstly, they should be citizens or permanent residents of Singapore, with a valid Identity Card (IC) to prove their residency. The minimum age requirement is 21 years old. For first-time home buyers, a Gross Monthly Income (GMI) threshold must be met, ensuring affordability. This income criterion varies based on family size and other factors.

Additionally, Punggol Executive Condos are subject to balloting as they are limited in supply. Applicants who meet the initial eligibility criteria will need to participate in a ballot system where successful applicants will secure a chance to purchase these exclusive properties. This process is designed to ensure fairness and equal opportunities for all interested buyers.

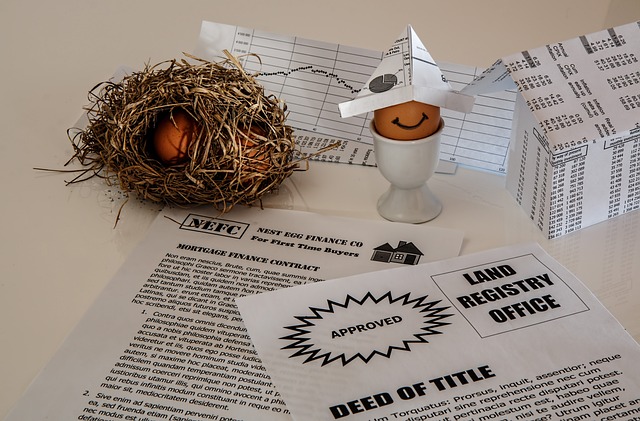

Lender Requirements and Documentations Needed

When applying for a loan for an Executive Condo at Punggol, lenders will have specific requirements and documentation needs to ensure compliance with regulations. Typically, they will require detailed financial information, such as proof of income through payroll slips or tax returns, to assess your ability to repay the loan. Bank statements and investment portfolios may also be demanded to verify your overall financial health.

Additional documents like identification cards, employment contracts, and property ownership evidence (e.g., a Certificate of Title) are essential. Lenders may also request details about any existing loans or mortgages to understand your current financial obligations. The process aims to provide a comprehensive view of your financial standing before approving the loan for this premium housing option in Punggol.

Interest Rates and Repayment Options Explained

When considering an Executive Condo loan for a property like those found in the vibrant Punggol area, understanding interest rates and repayment options is crucial. Interest rates are the cost of borrowing money, typically expressed as a percentage of the loan amount. For Executive Condo loans, these rates can vary based on factors such as your credit history, the lender’s policies, and current market conditions. It’s important to shop around for the best rates from different financial institutions.

Repayment options offer flexibility in how you pay back the loan. Standard repayment plans usually involve equal monthly installments that include both principal and interest. However, some lenders may offer accelerated repayment schedules or partial payment options. For an Executive Condo at Punggol, a thoughtful repayment strategy can help manage cash flow while ensuring timely loan repayment.

Location-Specific Benefits of Punggol Executive Condos

Punggol, a vibrant and rapidly developing region in Singapore, offers a unique set of advantages for those considering an Executive Condo purchase. One of the key benefits is its strategic location, providing easy access to both urban conveniences and natural escapes. Residents enjoy proximity to modern amenities, with shopping malls, schools, and healthcare facilities within reach. The area’s robust transportation network, including the Punggol Waterway and various bus services, makes navigating the city a breeze.

Moreover, Punggol’s scenic beauty sets it apart as an ideal family-oriented neighborhood. The region boasts lush parks, nature trails, and waterfront views, encouraging outdoor activities and fostering a sense of community. These location-specific benefits make Executive Condos in Punggol an attractive option for buyers seeking a balance between urban lifestyle and tranquil living.

The Application Process: Step-by-Step Guide

The application process for an Executive Condo loan at Punggol involves several key steps, designed to ensure a smooth and informed journey for prospective buyers. Firstly, potential borrowers should research and compare different lenders’ offerings, considering factors like interest rates, repayment terms, and loan eligibility criteria. This step is crucial as it allows applicants to find the most suitable loan package aligned with their financial capabilities.

Once a lender is chosen, the application can begin. Applicants need to provide comprehensive financial documentation, including income statements, employment details, and asset statements. Lenders may also require supporting documents like identification cards and property-related information. The application should be submitted along with any required fees, after which the lender will assess the application and verify the provided information. This process typically involves a credit check and an evaluation of the Executive Condo’s value to ensure it meets the loan-to-value ratio guidelines.

When considering an Executive Condo at Punggol, understanding the loan guidelines is crucial. This comprehensive guide has walked you through the eligibility criteria, lender requirements, interest rates, and application process specific to these unique properties. By harnessing location-specific benefits, prospective buyers can make informed decisions, ensuring a smooth journey towards owning your piece of the vibrant Punggol landscape.